New Budget Tax Slab - The wait is finally over! The Indian Union Budget 2023 has been unveiled and it's packed with exciting new initiatives and plans for the country's growth and development. From boosting the economy to strengthening infrastructure, this year's budget promises to bring about a positive change for every citizen. Get ready to discover what this budget has in store for you and how it will impact your daily life.

New budget 2023 The wait is finally over! Taxpayers across India can now breathe a sigh of relief with the latest updates on the new budget tax slab. The Union Budget 2023 brings a ray of hope for all with its exciting changes in the tax regime. Tax slabs in new budget - The "new budget tax slab" has been designed to cater to the needs of taxpayers and provide them with the financial stability they deserve.

New Budget Tax Slab With great interest and anticipation, many people have been searching for the latest updates on the tax slabs in the new budget. The Union Budget 2023 has brought some exciting changes in the tax regime, making the "new budget tax slab" a topic of great significance. The "tax slab in the new budget" has been eagerly awaited by taxpayers all over India, who have been eagerly waiting to see how the "new budget 2023" will impact their wallets.

New Budget Tax Slab

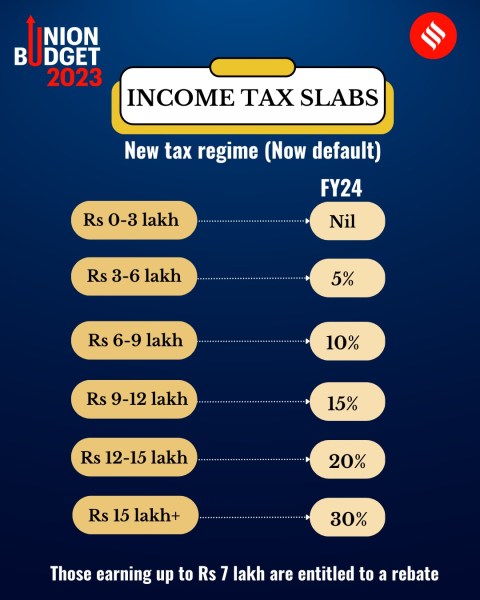

Tax slabs in new budget - The Finance Minister announced a change in the income tax rebate limit during the recent budget presentation. The limit has been raised from INR 5 lakh to INR 7 lakh for those who fall under the new tax regime. Those who earn between INR 3 lakh and INR 6 lakh will be subject to a 5% tax, while those earning between INR 6 lakh and INR 9 lakh will be subject to a 10% tax. For those earning between INR 9 lakh and INR 12 lakh, the tax rate will be 15%. A 20% tax rate will be imposed on those who earn between INR 12 lakh and INR 15 lakh, and those earning INR 15 lakh or more will be taxed at 30%.

Here are the revised tax slabs under New Budget Tax Slab

🔴 Income of Rs 0-3 lakh is nil.

🔴 Income above Rs 3 lakh and up to Rs 6 lakh to be taxed at 5% under new regime.

🔴 Income of above Rs 6 lakh and up to Rs 9 lakh to be taxed at 10% under new regime.

🔴 Income above Rs 12 lakh and up to Rs 15 lakh to be taxed at 20% under new regime.

🔴 Income above Rs 15 lakh to be taxed at Rs 30%.

The government, meanwhile, also proposed to reduce highest surcharge rate from 37 per cent to 25 per cent in new tax regime.

In conclusion, the new budget tax slab is a positive change for the taxpayers of India and is expected to bring many benefits in the long run. The new budget 2023 is a step in the right direction and will help in the growth and development of the Indian economy. The tax slabs in the new budget are transparent and fair, making it easier for taxpayers to understand their tax obligations and plan their finances accordingly.